Our Approach

Differentiated approach: Producing unique returns requires a unique approach

Exceptional focus on seeking primary source public information; Regulation FD compliant and no "expert networks" when investing in the public markets.

- Over a decade of gleaning contacts within our coverage universe

- We have established relationships with key sources who monitor government affairs, macro drivers, and geopolitical developments. These resources provide valuable context with which to construct views

- Our goal is to unearth material differences between market expectations and our own independently generated projections of an asset's earnings power

- Our analysis looks to challenge stock-specific consensus views and develop a high conviction thesis. We expect the deviations between our projections and market consensus to result in either positive or negative surprises for market participants and profitable opportunities for us

Dynamic, proactive risk management practices.

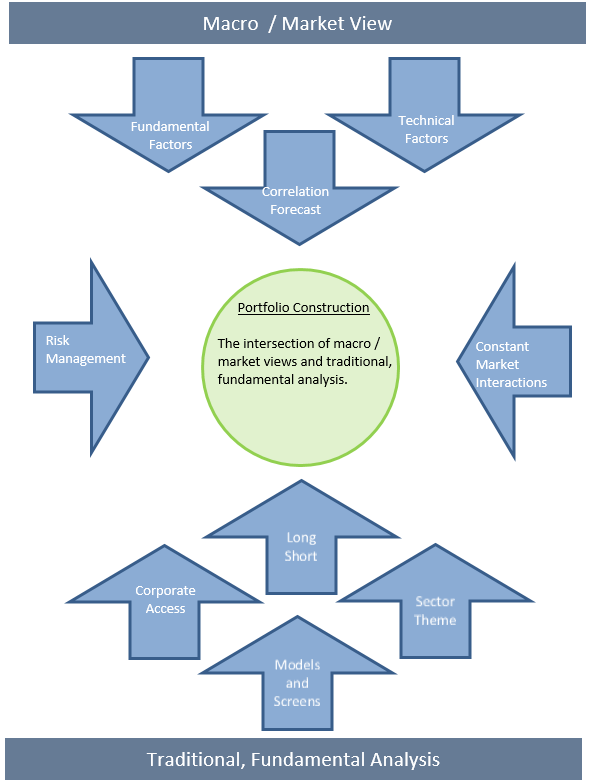

- Portfolio construction and position sizing (detailed in this presentation) are a critical element of our consistency. While we aim to deploy these skills adeptly, they are not our primary point of differentiation within the scope of risk management

- We have identified a suite of indicators which present when the likelihood of a performance drawdown becomes elevated. Furthermore, we developed a series of tools to track these indicators

- To be clear, we are not market-timers. The indicators referenced above are cues from our portfolio and focus investments and NOT the broad-based market

- When our indicators flash caution, we proactively offset the undesirable portfolio characteristics

- We believe this proactivity permits core, fundamental stock views to endure and permits us to express a differentiated view within the context of very tight risk constraints

These key elements differentiate our approach. They – along with our experience, pride, and enthusiasm – define our competitive advantage. We believe this will permit us to consistently produce positive returns from portfolios composed of liquid, widely followed individual instruments.