Multi-asset class oversight (MACO)

Multi-asset class oversight (MACO)

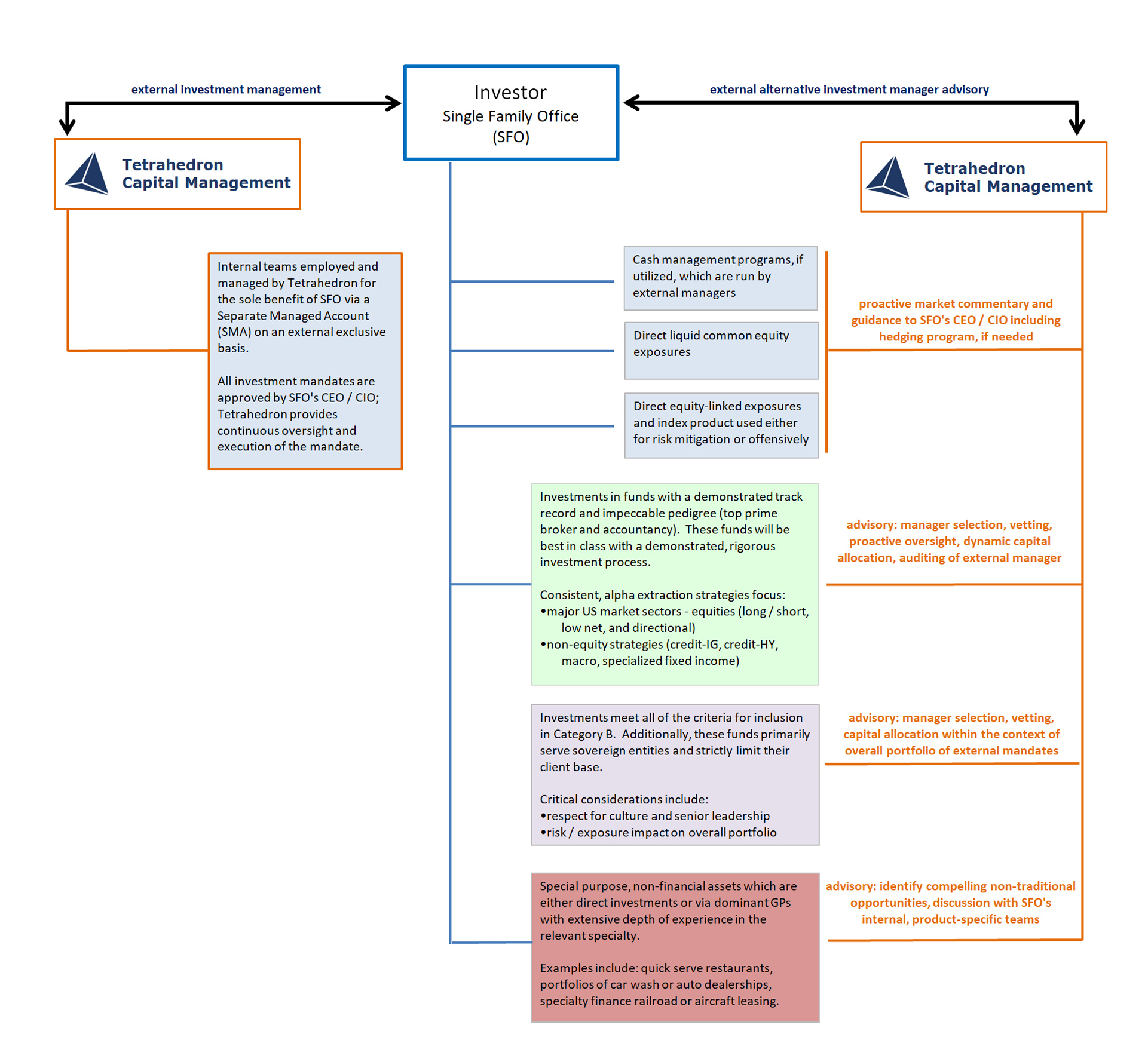

Tetrahedron authored a MACO program for a non-US single family office with an AUM of >USD$10bn. This family office wanted a comprehensive program to serve as the foundation for investments in the Americas. The program categorizes asset classes by liquidity characteristics. Tetrahedron provides the family office with extensive market experience and works as an extension of its in-house investment professionals. Each MACO program is bespoke; an example is depicted below.

Asset Categories (the single family office investor is abbreviated SFO)

Immediate Liquidity: Category A

90% of the portfolio provides 24 hour liquidity; 100% of the portfolio provides redemption in 3 business days.

Investment exposures are fully transparent.

High Liquidity: Category B

SFO sets or significantly influences the terms of its investment. The ability to invest in the management company of the manager may occasionally present in this category.

Investment exposures are fully transparent.

Lower Liquidity: Category C

These investments are at the LP level in funds which are the dominant participants and have produced world class returns with a mature track record. Terms offer minimal flexibility.

Investment exposures are not available in a detailed format.

Not Liquid: Category D

Exposures taken in investment vehicles with a commitment of 5 to 7 years.

Investment exposures are available in a detailed format